Blue Wolf targets high quality middle market companies in niche industries, most often healthcare, forest and building products, energy services, and industrial and engineering. We back businesses we believe can thrive through disciplined management, strongly aligned incentives, an ESG approach, and a strategy that takes into account a wide variety of additional factors, including changing markets and regulation.

Investment Criteria

Control Equity Investor

Unique Value Add

Blue Wolf seeks to invest in companies where our team of seasoned professionals has the ability to bring unique value add in three areas:

Industry Breadth and Depth

Blue Wolf’s current focus industries include:

- Healthcare Services

- Forest and Building Products

- Niche Manufacturing

- Industrial & Engineering Services

However, we are prepared to leverage our approach across a diverse set of investments. We remain agile and open-minded to opportunities which allow us to leverage Blue Wolf’s Unique Value Add.

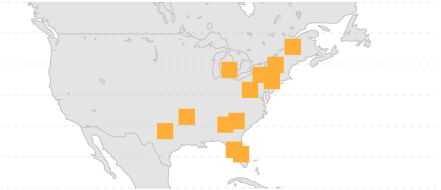

Geography

Blue Wolf invests primarily in companies headquartered in the United States and Canada. We view positively businesses with substantial international presence and sales. We consider international add-on acquisitions, particularly in Europe.

Size

Blue Wolf seeks to invest meaningful amounts of capital in each portfolio company. Generally,

Annual revenue more than

$50 million

Enterprise Value

$50–$500 million

Equity Investment

$25–$250 million

We may invest less than this in a platform company with a well-considered growth or consolidation plan.

Defensible Core Business

Blue Wolf commonly invests in Special Situations which other investors deem too complex or too difficult. We have the courage to exercise thought leadership based on industry knowledge and systematic and rigorous due diligence. Going Concerns / Established Companies Blue Wolf’s focus is on businesses seeking institutional capital, including corporate subsidiaries and family and entrepreneurially run companies. While we are prepared to invest in companies needing a substantial change in organization to thrive, we do not invest in start-ups or re-starts of closed businesses. Differentiated We seek companies that possess one or more points of unique differentiation Possess Unique IP We prefer businesses that enjoy the benefits of owning or controlling proprietary intellectual property Diversified with Minimal Concentration We carefully evaluate risk pertaining to concentration across customers, products/services, channels to market, and otherwise.